In spring of 2023, the Commission released an updated version of the Requirements Manual and a document outlining the changes. Each month we will highlight a change, why we made it and why it is important. This month we are looking at an UPDATED finance requirement.

In spring of 2023, the Commission released an updated version of the Requirements Manual and a document outlining the changes. Each month we will highlight a change, why we made it and why it is important. This month we are looking at an UPDATED finance requirement.

Why is it important?

- An annual financial evaluation ensures a land trust's board has reliable information to fulfill its financial oversight responsibilities.

- The Manual establishes requirements land trusts across the nation must meet in order to operate a fair and credible program regardless of where a land trust is located. The requirements are based on an analysis of the thresholds set by a majority of states as well as standards set by other nonprofit charity evaluators.

What Changed?

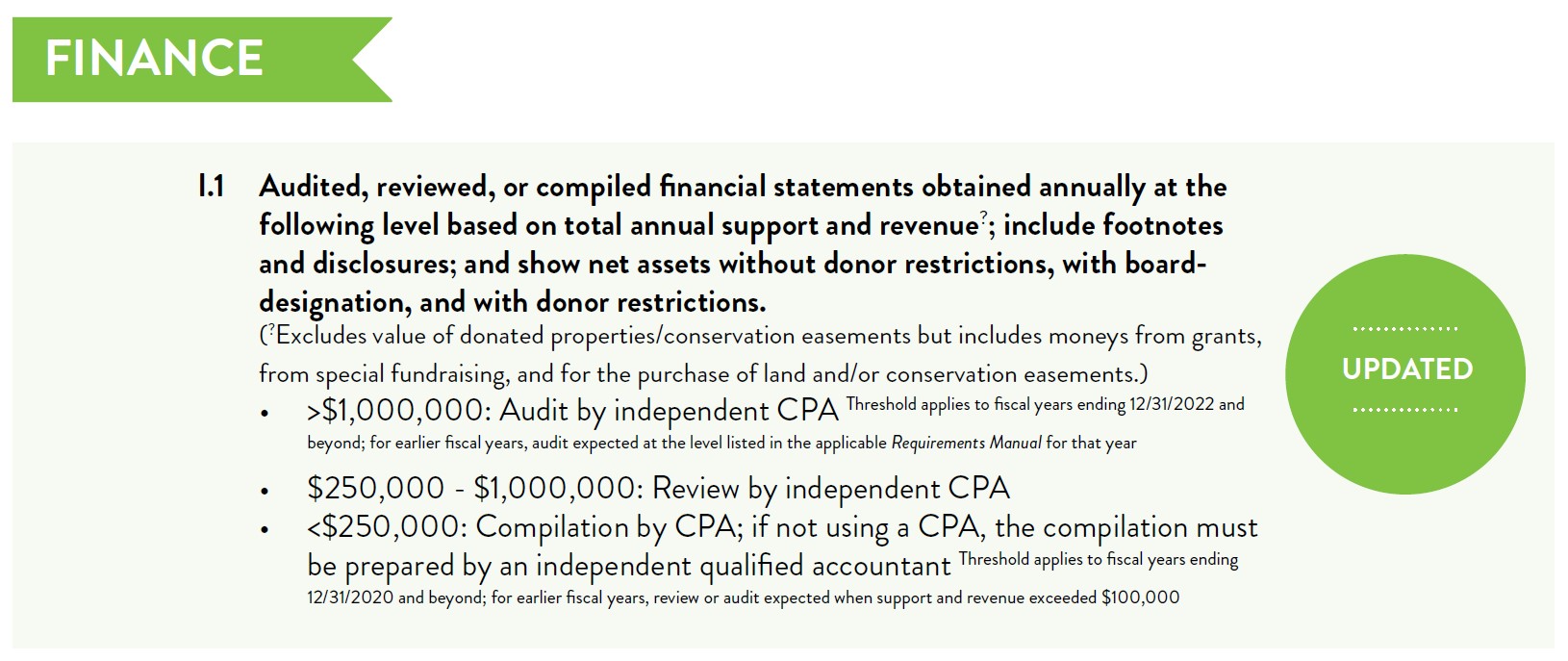

- The threshold for when an audit is required has been raised from $750,000 to $1,000,000 for fiscal years ending 12/31/2022 and beyond. For earlier fiscal years, audits are expected at the level listed in the Manual in effect for that year.

- Land trusts are encouraged to review state law to ensure compliance and make changes as needed to any related organizational policies.

- The chart below shows how the thresholds have changed over the last few years, such as the threshold for obtaining a review being raised to $250,000 in 2021. Renewal applicants must meet the minimum requirements in effect during their accredited term – different thresholds apply to different years. For example, if your land trust's total revenue and support in 2017 was $600,000, you would need to have obtained an audit for that year.

Why the Change?

- The Commission heard from several land trusts asking that the threshold for an audit be evaluated. In response, the Commission reviewed other industry standards, including the Wise Giving Alliance's Standards for Charitable Accountability, and various state law requirements and found that raising the threshold to $1,000,000 was consistent with these.

- The current application includes the documents needed to demonstrate compliance; no new documents will be requested.

Additional Resources

To learn more about the External Financial Evaluation requirement, the Alliance has several resources available on The Resource Center.

- Detailed guidance for practice element 6C1

- A 15-minute course on obtaining an annual financial audit, review, or compilation

- A 15-minute course on what to expect when engaging in an audit